KeyBank Sets a New Trajectory with Automation

Adopting digital capabilities is essential for lenders to rise above current market challenges. Take KeyBank for example – they’ve embraced the industry’s digital evolution and have strategically grown their business since implementing Loan Product Advisor® (LPA®). This decision has resulted in positive outcomes: resource optimization, process efficiencies and a better borrower experience for an expanded number of borrowers.

See how the integration of LPA and use of LPA’s digital capabilities accelerated their lending business.

AIMing for Automation Through a Phased Approach

KeyBank relied primarily on other automated underwriting systems (AUSs) for loan approvals. As business grew, they knew diversifying their investment in technology would help increase opportunities to make home ownership possible for more of their borrowers. That’s when they decided to begin using LPA. With guidance from Freddie Mac’s LPA experts, KeyBank was able to successfully implement and operationalize LPA in less than one year.

One of the biggest benefits for KeyBank was automating the assessment of borrower assets, income and employment. By using LPA’s asset and income modeler (AIM), KeyBank was able to use data, to close faster. Within three months of using AIM, KeyBank was able to automate assessments for more than 50% of their loan applications submitted through LPA. Along with other institutions that are also successfully using LPA, KeyBank is experiencing excellent results, with LPA and AIM paving the way for a new digital standard.

Before KeyBank could reap the benefits, they mapped out their LPA implementation and rollout through a phased approach.

Unlocking Opportunity – LPA Introduction (November 2023)

To get underwriters comfortable with using LPA, loans that were not approved in other AUSs were run through LPA for an assessment, which gave underwriters the opportunity to practice using the interface. Underwriters received customized testing and training assistance from Freddie Mac for a smooth learning experience.

Unlocking Efficiency – Dual AUS Rollout (February 2024)

KeyBank then rolled out LPA to their loan officers through a dual AUS approach that provided their underwriters with multiple views of risk. LPA also enabled KeyBank to introduce Freddie Mac’s affordable Home Possible® mortgage loan to their customers, helping them give their borrowers more options. By the end of this phase, KeyBank was already seeing a 15% increase in loan approvals through Freddie Mac’s products and its LPA – showing the value of bringing in another AUS.

Unlock Savings – Taking it up a Notch with Automation (May 2024)

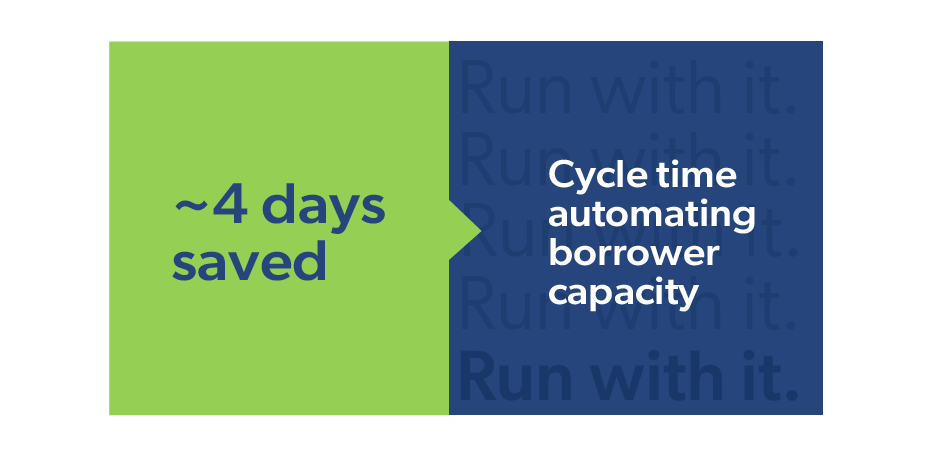

The next phase introduced AIM capabilities to expedite digital verification of borrower income, assets and employment. KeyBank and their point of sale (POS) provider worked alongside Freddie Mac to implement the technology and train staff on how to optimize AIM. KeyBank then built out logic in their loan origination system (LOS). LPA provided categorized feedback messages and AIM displayed representation and warranty (R&W) relief eligibility indicators so loan officers and underwriters could close loans more efficiently and confidently.

Powerful Results to Speed Up Underwriting Unlocked

Incorporating more digital capabilities has helped KeyBank originate more efficiently – here are the numbers to prove it.

Get The Keys to Success

KeyBank runs LPA and AIM and now they’re sharing their keys for success:

Set Your Trajectory to Opportunity, Efficiency and Savings

KeyBank’s story shows how the decision to implement LPA opened many opportunities for business growth. They’ve had significant success, particularly with AIM, and are an example why others should join the digital evolution. A simpler, faster origination process and better borrower experience helps KeyBank do more for their customers and you can achieve the same too.

“We are committed to helping as many borrowers as possible at every stage of homebuying,” said Dale Baker, President of Home Lending for KeyBank. “Rolling out LPA supports that goal as reflected in our increased loan approval numbers. In addition, when Freddie Mac’s Home Possible became part of our affordable product lineup, it allowed us to help even more borrowers make their dream of owning a home a reality. Freddie Mac was with us every step of the way, from inception to implementation.”

Getting Started with LPA

Contact your Freddie Mac representative or the Customer Support Contact Center (800-FREDDIE) today.

Learn More About AIM

Check out recommended training resources to help you learn more about AIM and its capabilities: